Career / Professional Qualifications

Students who wish to be Actuaries

Actuaries serve the broader financial community by bringing their expertise in mathematics, statistics, and financial theory to the quantification and evaluation of risks that are related to uncertain future events. This expertise is particularly valuable in relation to insurance and pension programmes. Actuaries may work for insurance companies, consulting firms, government bodies/agencies or in the employee benefits departments of large corporations, banks, and investment firms. In fact, any business that has substantial financial risk to manage will benefit from the services of an actuary.

The first step toward a career as an actuary is to study in an actuarial (or actuarial-based) programme such as our IFAA programme, which offers students the opportunity to pass four or more of the actuarial exams that are held by the Society of Actuaries or the Casualty Actuarial Society and Institute and Faculty of Actuaries. Most employers in Hong Kong require university graduates to pass two or more of these examinations. Students who have passed four or more are very marketable upon graduation. Employers generally prefer their junior actuaries to gain knowledge and experience while working and are, therefore, likely to be supportive of exam-related studies.

Professional Examinations

To become an actuary, students need to pass actuarial examinations. Examinations held by the Society of Actuaries (SOA) are divided into two parts: written examinations and Validation by Educational Experience (VEE). The courses below are relevant to the SOA professional examinations, which are held at least twice a year. Graduates of our programme will normally pass four to five examinations in the SOA requirements for Associateship.

Knowledge on Economics, Accounting, Finance and Mathematical Statistics are generally not tested by written examinations, but by taking relevant validated courses for these subjects in qualified universities and obtaining good grades. CUHK offers such courses that fulfill these criteria. So, students who have completed our programme will have fulfilled the SOA requirements in these areas. Our graduates, therefore, have an advantage over graduates of other programmes.

| Financial Mathematics | FINA 2200 |

| Probability | FINA 2220 |

| Statistics for Risk Modelling | FINA 3290, FINA 3295 |

| Fundamentals of Actuarial Mathematics | FINA 3221, FINA 3222 |

| Advanced Long-term Actuarial Mathematics | FINA 4211 |

| Advanced Short-term Actuarial Mathematics | FINA 4221 |

| Economics | DSME 1030, DSME 1040 |

| Accounting and Finance | ACCT 1111, FINA 2010 |

| Mathematical Statistics | FINA 2230 |

You can find more details about the actuarial profession on the SOA Web site at www.soa.org.

Students who wish to be Insurance Professionals

IFAA graduates are equipped with necessary trainings to pursue a variety of careers in insurance as underwriters, insurance adjusters/examiners or risk managers, amongst others.

Underwriters evaluate insurance applications to determine the risks entailed in issuing a policy. They scrutinise applications and decide whether to accept them, and, if so, determine the terms that will be acceptable and set a premium that accurately captures the risks therein. Insurance adjusters or examiners determine whether particular claims are covered by a customer’s policy, confirm payments and, in certain circumstances, investigate the background to a claim. Risk managers assess risks, such as the physical, liability and financial losses that may be incurred by insurance and non-insurance companies. In so doing, they are able to advise top management on risk-financing measures (including insurance purchases). Both buyers and sellers gain from the services of risk managers.

Students who wish to be Financial Analysts

The Chartered Financial Analyst (CFA) qualification confers advantage in several finance-related areas. Securities analysts, treasury (or money market) managers, corporate investment advisors (who focus principally on securities and investment issues) and other investment advisors are likely to reap significant career benefits from holding the CFA qualification. The CFA qualification is awarded by the CFA Institute (originally AIMR), which administers examinations and sets standards in experience, education and ethics. Graduates of the IFAA programme are well positioned to pursue careers as financial analysts in investment firms.

You can find out more about the CFA qualification from the CFA Institute website.

Student Career Placement

As of July 2023, most of our students graduated in 2022 − 2023 have secured jobs immediately upon graduation. Most of them are now working in banks, consulting firms and insurance firms, such as AXA, Bank of China (Hong Kong) Limited, BNP Paribas Hong Kong Branch, BOC Group Life Assurance, Chubb, Dah Sing, Deloitte, Ernst & Young Advisory Services, HSBC Insurance, KPMG Advisory, Manulife, MassMutual Asia, MetLife Asia, Munich Re, Nomura International Inc., Prudential Hong Kong, Sun Life and Willis Towers Watson. While the salary of a fresh graduate depends upon the position attained, qualities of the individual and economic outlook, our programme offers many opportunities for advancement in a number of key fields in the financial-services industry.

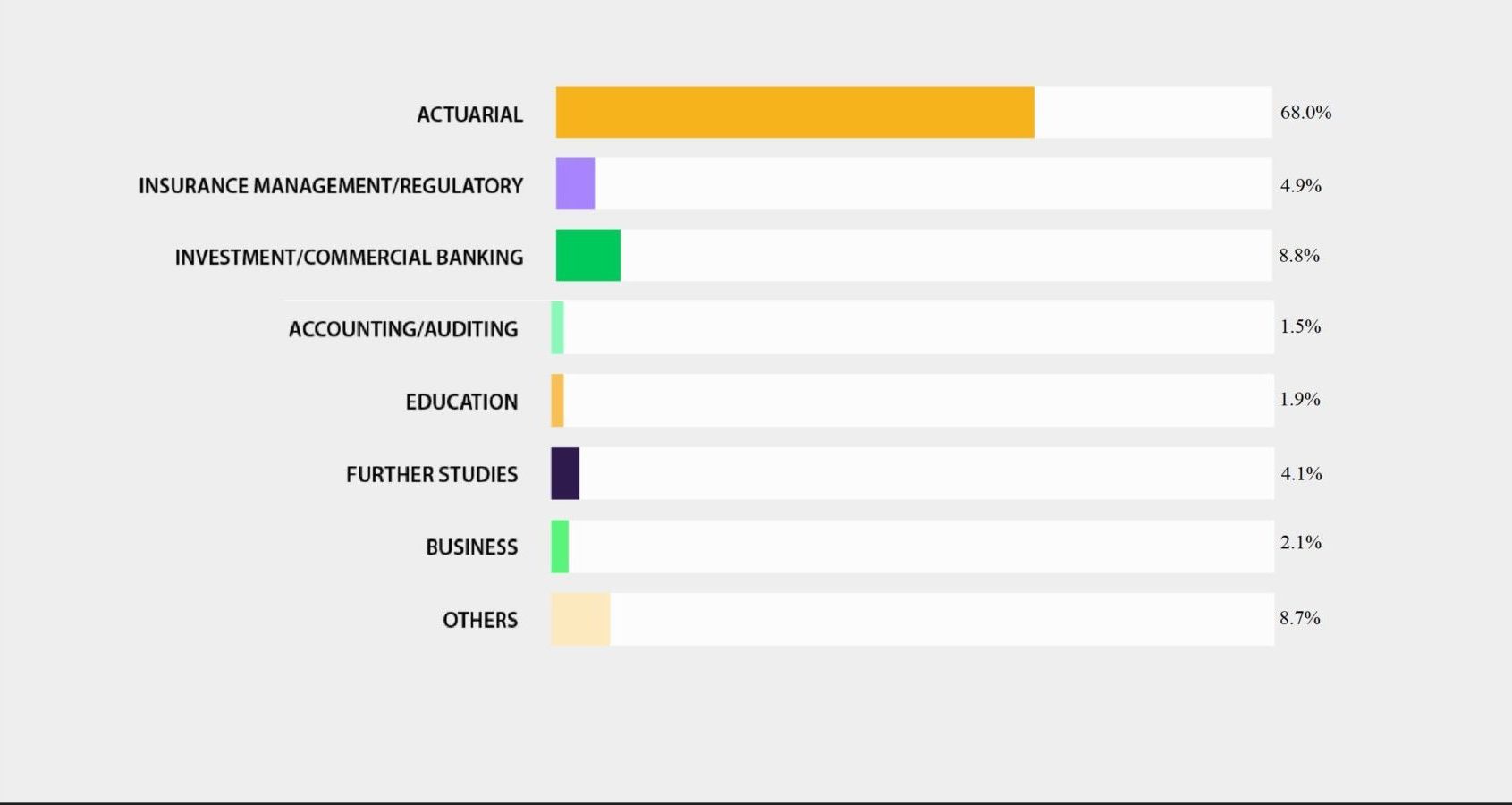

Distribution of Graduates (2005-2023) of IFAA Programme

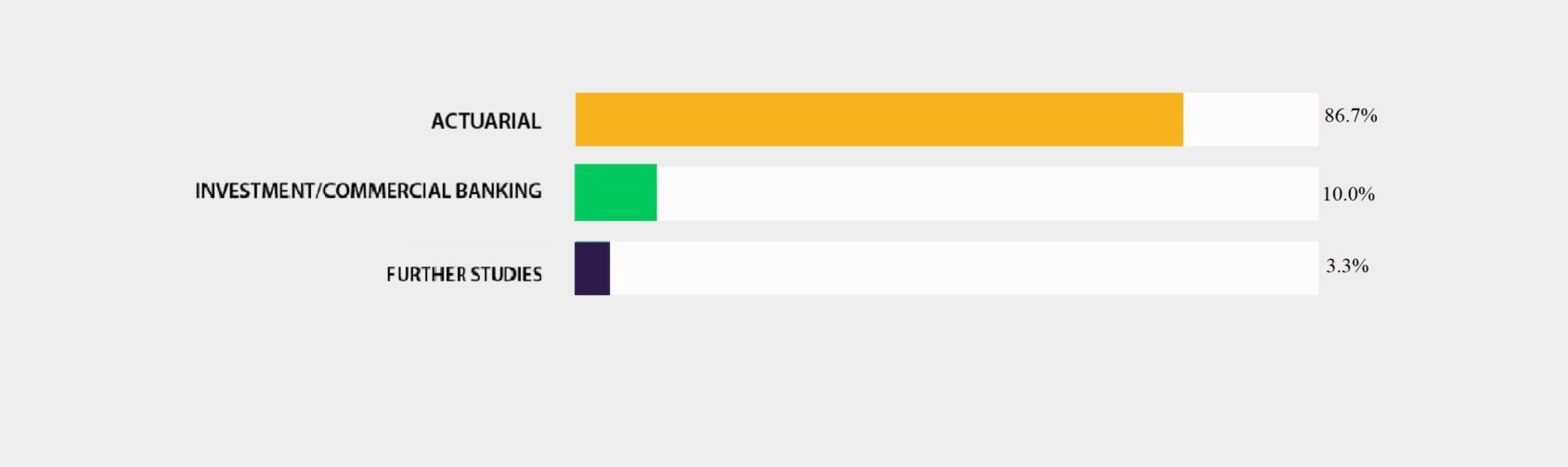

Distribution of Graduates (2022-2023) of IFAA Programme